+

+

$ B+

This is a $1.1 billion investment ($770 million private, $230 million public, $100 million OU Foundation) over the next seven years, 80% of which will come from the private sector. It’s estimated to generate over $3 billion in business spending over 25 years, including 34 million for the public safety sales tax.

The development is expected to create 5,078 jobs (FT, PT, and seasonal) and temporary construction jobs over nine years, with a low of 606 and a high of 2261.

The currently developed portion of UNP, between Rock Creek Road and Robinson, is the most heavily shopped center in the State of Oklahoma, and generates 8% of the City’s budget.

Residents can expect improvements in roads and stormwater infrastructure, in addition to the new businesses and buildings as part of the development, including more restaurants, entertainment venues, housing, and retail that help make our city vibrant and retain residents. It will also help retain talented young professionals who consistently complain that Norman has nothing for them to do.

Yes, there will be green space and walking paths as well as water features throughout.

This new development will have no negative impact on the school district.

According to the CFO of Norman Public Schools, “There are no Sinking Fund shortfalls because TIFs exclude Sinking Funds. This entertainment district is NOT in our current NAV, and not in our SF mill projections, so it has no impact on our current year mills/collections due us. We did NOT use a possible entertainment district in our SF mill levy estimates. We still collect our same 25.8 mills from the taxable net assessed valuation that was used in the calculation of that mill levy for this year. If/when this TIF property goes on the tax rolls, that in and of itself will cause our SF mills to drop that year it does go on the rolls…since that NAV will be added to our Total NAV. Higher value with no change to outstanding debt means each taxpayer would owe less for the current district debt obligation, and therefore could reduce a taxpayer’s SF mill levy on their own property tax stmt.”

The proposed business and entertainment district’s boundaries are Interstate 35, W Rock Creek Road, Max Westheimer Airport, and W Tecumseh Road.

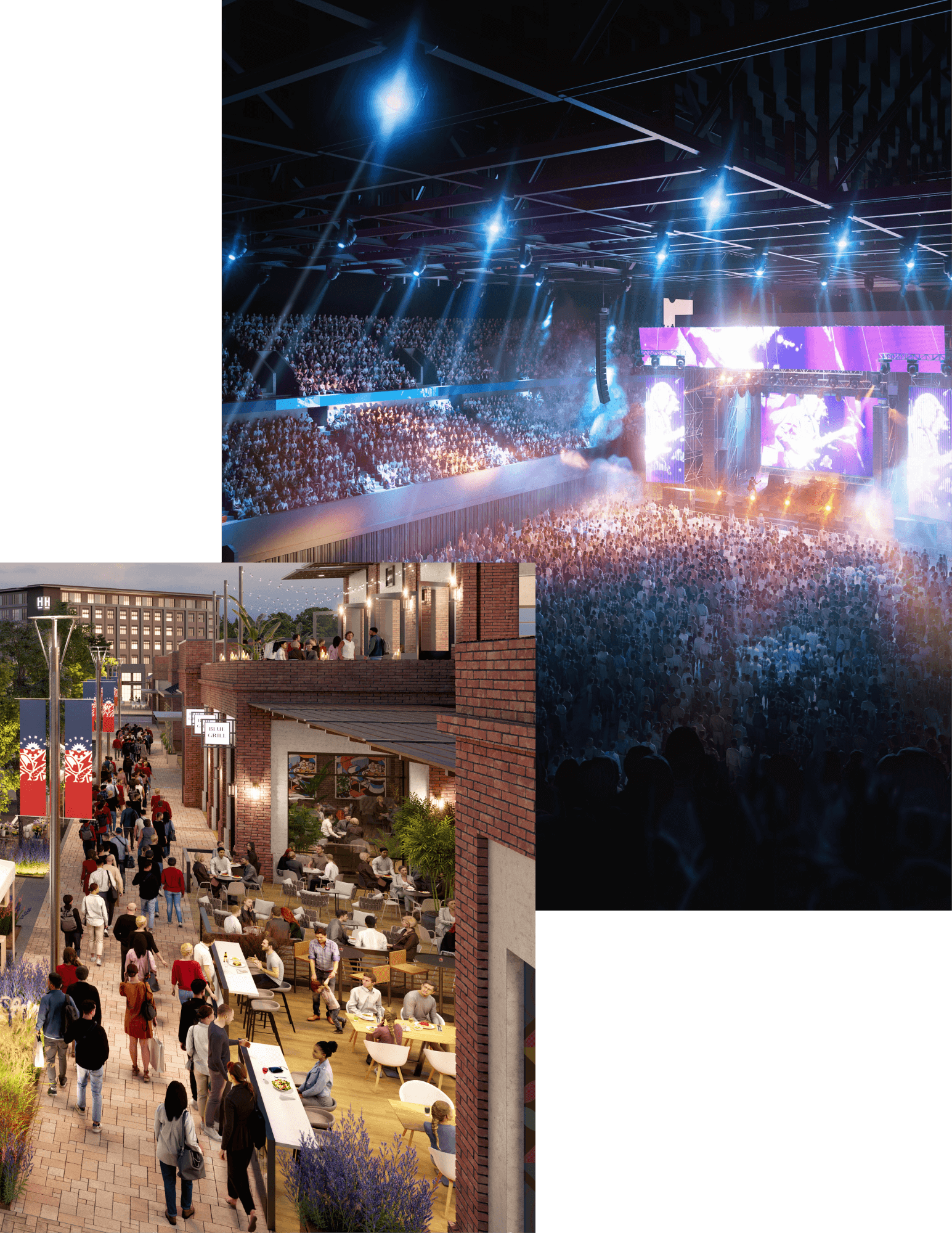

Under the development plan, the district would include multiple facets intended to benefit the entire Norman community and region, beginning with a multi-purpose performance venue that would attract major entertainment and sporting events. The plan also includes a new hotel, restaurants, bars, retail shopping, offices, housing, and other quality-of-life amenities that would make Norman a regional destination point.

Everyone! The multi-purpose venue would host everything from concerts and shows to University of Oklahoma women’s gymnastics and Sooner basketball games. Although the university would be the facility’s anchor tenant, current projections call for OU to use just 28% of its availability. The remaining 72% would be filled with major concerts, business expos, local graduations, shows, rodeos, and more.

Cleveland County has formed the Cleveland County Recreation and Entertainment Authority that would own and manage the performance venue. They will use a public bidding process.

The Cleveland County Recreation and Entertainment Authority is a public body, and meetings will require public notice.

The development is in Norman’s Ward 8.

There are portions of development controlled by the OU Foundation and portions controlled by NEDC, MNTC, and others.

The primary development will include a wide variety of businesses and facilities, including:

Over two-thirds of the events at the new arena venue will be dedicated to community programming for the arts and culture, graduations, and business conventions, contributing significantly to the quality of life for Norman residents to enjoy local shows.

All the necessary approvals have been obtained, including a final vote by the Norman City Council.

Some parcels will be sold, while others will have long-term ground leases. The entertainment venue will be managed by the Cleveland County Recreation and Entertainment Facilities Authority

The new Cleveland County Recreation and Entertainment Authority will oversee the entertainment venue. The authority has five members, three (3) of which are county commissioners, plus one (1) OU appointee and one (1) private-sector appointee.